The foundation of central banking in Somalia began under the Italian Trusteeship Administration (AFIS). In 1950, the Cassa per la Circolazione Monetaria della Somalia (CCMS) was created in Rome to issue and regulate currency. It introduced the Somalo currency on July 16, 1950, replacing the Italian Lira in Italian Somaliland. Meanwhile, British Somaliland used the Indian Rupee until 1951, and later the East African Shilling.

In 1954, Credito Somalo was established to provide credit for agriculture, livestock, and industry, later receiving a $2 million U.S. loan in 1959 to boost development—marking a significant turning point in Somalia's financial structure. By 1959, the CCMS relocated to Mogadishu, a key step toward financial autonomy before full independence.

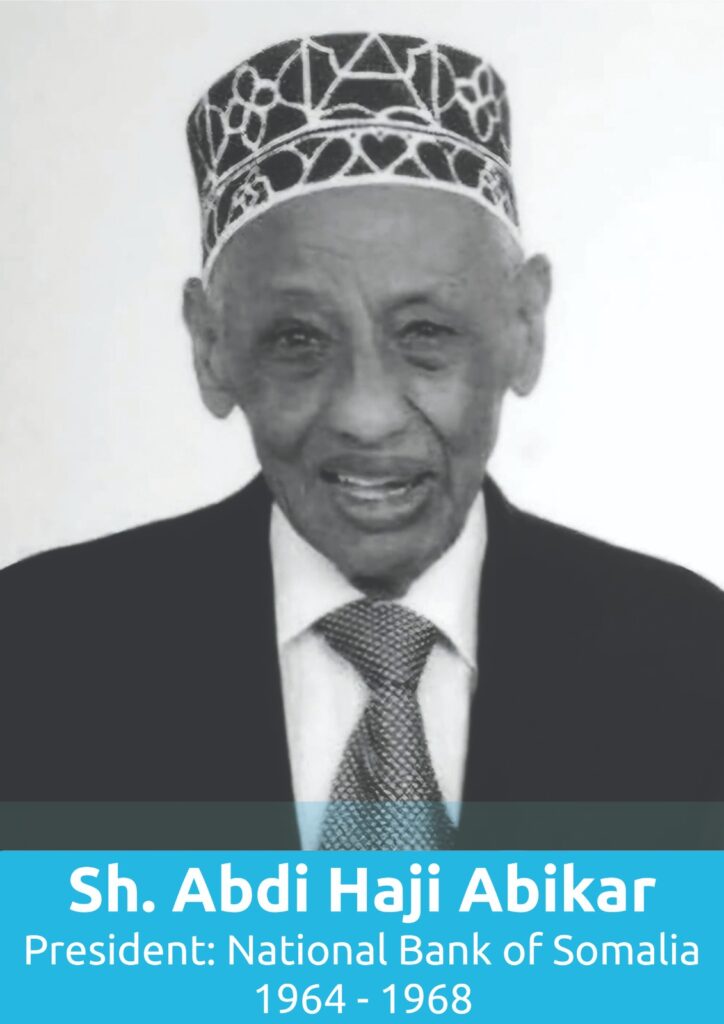

The Somali National Bank was officially established by Decree-Law No. 3 on June 30, 1960, just one day before Somalia gained independence. It was a defining institution for the newly sovereign state, taking over the functions of the CCMS and symbolizing the shift from a colonial economic system to one centred on promoting national sovereignty and self-determination in economic matters. The bank was responsible for managing the country's monetary policy, issuing currency, and supervising the banking system. These roles are critical in ensuring economic stability and growth in the newly independent Somalia.

Operations began on July 4, 1960, and the bank was tasked with:

The legal foundation was reinforced by Law No. 2 on January 13, 1961, confirming its autonomous legal and administrative status.

Notable milestones during this period include:

During this era, the Bank served both central and commercial banking roles, with departments focused on currency issuance and banking operations. This dual-role model remained in place until 1975.

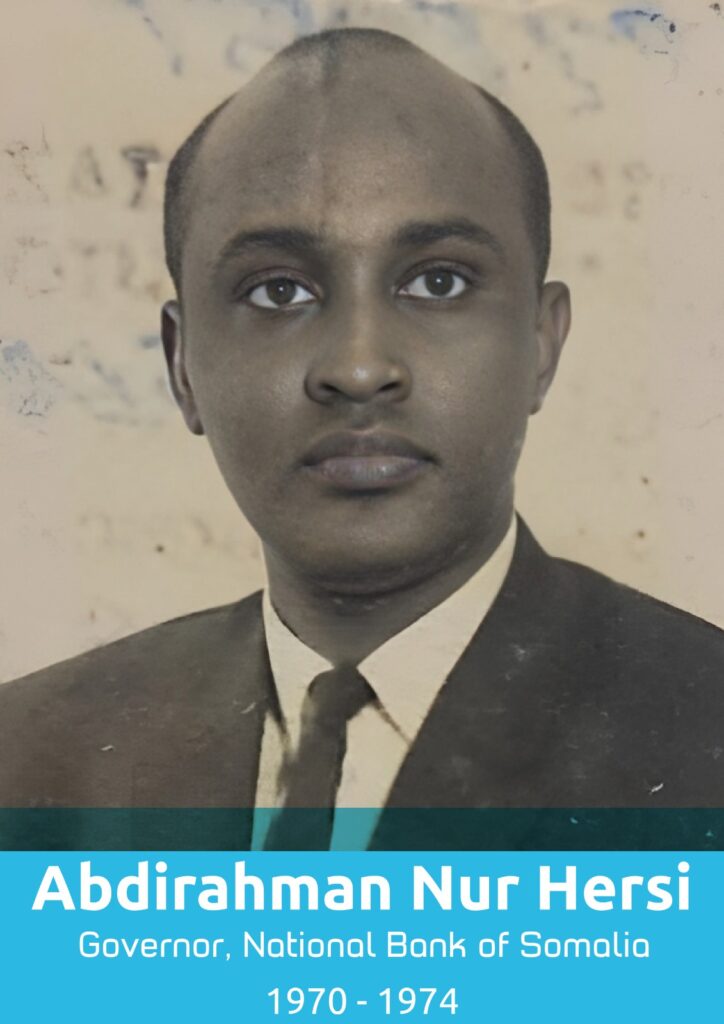

In 1975, the Somali National Bank was renamed the Central Bank of Somalia (CBS). This institutional change reflected a shift in focus from hybrid functions to a dedicated central banking mandate.

While CBS maintained oversight of monetary policy and financial institutions, its operations were deeply affected by national developments:

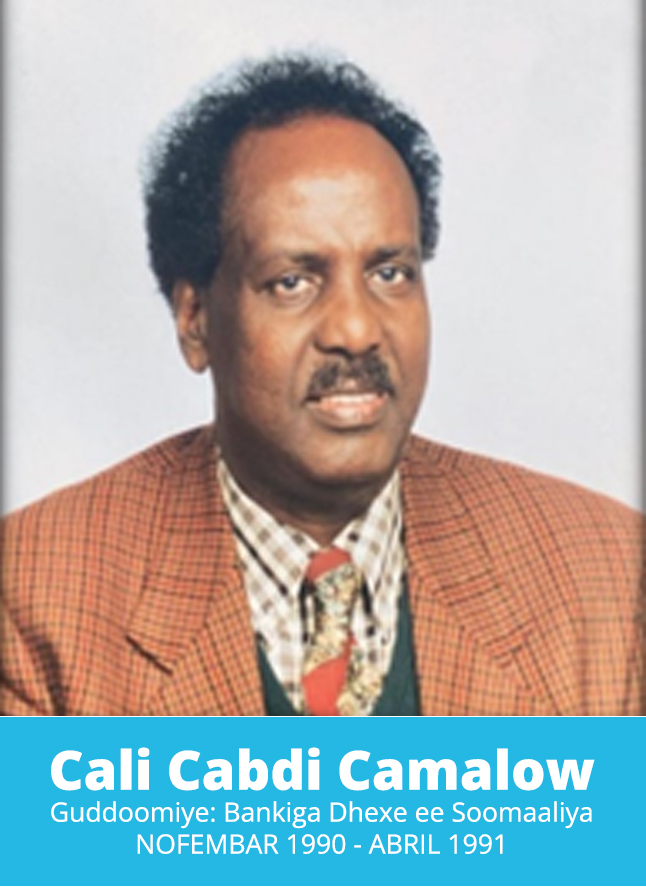

The situation further deteriorated, and in January 1991, the collapse of the Somali state led to the suspension of the CBS’s operations.

CBS was formally re-established under the Central Bank Act of 2012, restoring its role as Somalia’s monetary authority. Since then, the Bank has undertaken gradual yet significant reforms aimed at modernizing its operations and aligning with international central banking standards. However, frequent leadership changes have posed challenges to institutional continuity. Since 2012, five Governors have led the Bank:

Since 2020, the CBS has undertaken transformative reforms aimed at modernizing its institutional capacity, regulatory framework, and financial infrastructure. Key developments during this period include:

As Somalia moved closer to independence, the Italian Federal Government, which was responsible for the administration of Southern Somalia at the time, established the “Cassa per la Circolazione Monetaria della Somalia (C.C.M.S.)” in 1949, headquartered in Rome, Italy. This institution began printing a national currency named “SOMALO,” which replaced the former “East African Shilling.”

The SOMALO currency was ratified through Legislative Decrees Lr. 15 and 16 issued on 16 May 1950. The central office of the monetary institution was transferred from Rome to Mogadishu on 6 April 1959, where it fully assumed the responsibilities and assets of the Mogadishu branch of Banca d’Italia.

After gaining independence, the Somali Government introduced a new national currency called the Somali Shilling. Its technical specifications were outlined in Presidential Decree Lr. 86 of 5 March 1962 and formally issued under Legislative Decree Lr. 2 of 5 June 1962. It officially entered into circulation throughout the country on 15 October 1962.

In 1968, the National Bank of Somalia replaced the earlier coinage in use since the 1950s with new designs, sizes, inscriptions, and metals. These coins were approved through Presidential Decrees Lr. 174 and 175 issued on 3 July 1968 and entered circulation on 4 November 1968. The previous coins were withdrawn by 31 December 1970.

![]()

As part of institutional reforms, Law Lr. 21 of 8 February 1975 officially renamed the “National Bank of Somalia” as the “Central Bank of Somalia.” This change also affected previously issued banknotes authorized under Presidential Decree Lr. 134 of 1974.

Newly printed banknotes bearing the updated name were authorized by Decree Lr. 74 of 6 December 1977 and enforced through Ministerial Decree Lr. 18 of 22 March 1978. These banknotes entered circulation nationwide starting 25 March 1978.

![]()

![]()

Referring to Somalia’s monetary laws, the Governor of the Central Bank submitted a request to issue new banknotes. The Supreme Revolutionary Council approved the issuance through Decree Lr. 67 of 30 December 1982.

Due to severe currency devaluation, the Central Bank of Somalia introduced a higher-value banknote of 500 Somali Shillings to reduce the volume of notes in circulation.

Facing rising printing costs of smaller denominations, the Somali Government decided to introduce a high-value note. While a joint letter was sent to the IMF on 3 June 1990, the 1,000 Shilling note was already in circulation by 15 May 1990, as stated in Ministry of Finance Decree Lr. 6 of 7 May 1990.

The Central Bank of Somalia was established in 1960 as Banca Nazionale Somala and became the Central Bank in 1975. After years of collapse following 1991, it was revived in 2009 and strengthened by the CBS Act of 2012. Today, it is the primary institution responsible for monetary stability and financial sector regulation in Somalia.

Copyright ©️ CBS 2025 All Rights Reserved.